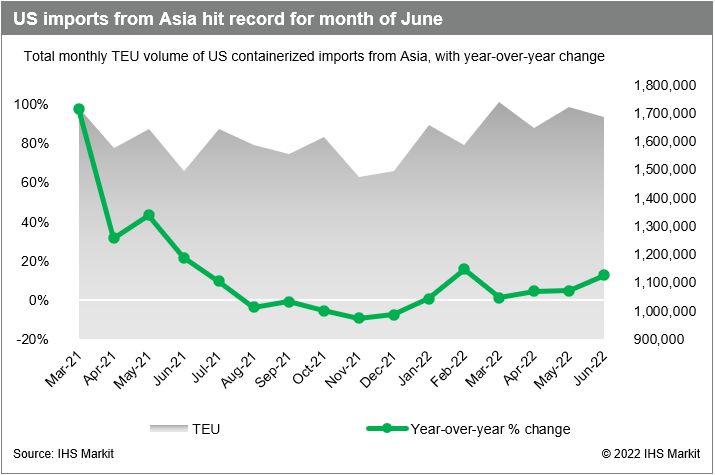

US imports from Asia highest ever for month of June

US imports from Asia rose 12.7 percent in June year over year — making it the busiest June ever on the eastbound trans-Pacific — as retailers front-loaded fall merchandise to stay ahead of supply chain bottlenecks and as a hedge against possible disruptions during longshore labor negotiations now under way on the West Coast.

Meanwhile, imports through the first half of the year were up 6.2 percent over the first six months of 2021, according to PIERS, a JOC.com sister company within S&P Global.

The higher imports for June and the first half of 2022 show that consumer spending has so far not been muted by rising inflation and three months of COVID-19 lockdowns in Shanghai, the world’s largest container port.

US imports from Asia totaled 1.69 million TEU last month, a new record for June. On a month-to-month basis, June imports were down 2 percent from 1.72 million TEU in May. Retailers expect monthly imports in the second half of the year to remain at or near record levels, according to the Global Port Tracker, which is published monthly by the National Retail Federation and Hackett Associates.

The Port of Los Angeles, which released its June cargo figures Wednesday, reported its busiest June ever for total container volumes, including laden imports and exports and empty container returns. Gene Seroka, executive director of the largest US port, said the product mix in the second half of 2022 will shift from inventory replenishment to back-to-school and holiday merchandise.

“The volume coming in now was ordered three to four months ago,” Seroka told a press conference Wednesday. “The cargo that will be coming in is different than the cargo on the ground. I see the peak season as being strong.”

PIERS data show imports from Asia in the first half of 2022 were up 31.3 percent from the first six months of pre-pandemic 2019. With the base level for cargo volumes now 25 to 30 percent higher than it was before COVID-19, already-stressed US ports and the inland supply chains they feed must prepare for near-record volumes even if year-over-year monthly increases are in the low to mid-single-digit range.

“Supply chain challenges will continue throughout the remainder of the year,” Jonathan Gold, NRF’s vice president for supply chain and customs policy, said in the July 8 Global Port Tracker.

By Bill Mongelluzzo at JOC

View All News Articles