India-US Ocean Rates seen inching to COVID peaks on Red Sea Woes

While India-US ocean rates are still below the levels seen at the height of pandemic-induced supply chain disruption, current Red Sea-linked fluctuations make a case for carriers to be able to push their pricing on the trade lane to second-half 2022 highs by the end of this month.

According to the latest market updates obtained by the Journal of Commerce from local freight forwarders, short-term contract prices from India to the US have seen a two- to three-fold jump, on average, in the last two weeks,

For example, average rates from West India (Nhava Sheva/Mundra) to the US East Coast (New York) now stand at $4,471 per TEU and $4,611 per FEU, up from $1,473 and $1,890, respectively, in late December. That upward movement closely aligns with the $4,732 per TEU the Journal of Commerce reported for November 2022.

Similarly, contract rates to the US West Coast (Los Angeles) have shot up to $3,719 per TEU and $4,104 per FEU from $1,563 and $1,859, while rates to the Gulf Coast (Houston) have jumped to $4,704 per TEU and $5,446 per FEU, from $1,934 and $2,426.

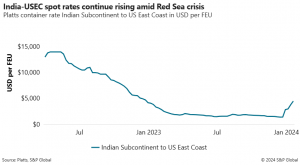

Meanwhile, spot rates from India to the US East Coast were $4,500 per FEU as of Jan. 15, up from $3,000 per FEU 10 days ago, according to Platts, a sister company of the Journal of Commerce within S&P Global.

India-USEC spot rates continue rising amid Red Sea crisis

Platts container rate Indian Subcontinent to US East Coast in USD per FEU

Short validity for price quotes

Forwarders voiced concerns that carrier rate quotes are now mostly valid only for a week or in some cases, for a specific sailing, compared with the normal 30-day validity extended to regular booking customers.

Tej Contractor, director at Mumbai-based forwarder MCC Container Lines, noted that rates have been rising up to three times week on week.

“While there has been an impact (on operations), carriers have rushed to use this crisis to their advantage,” Contractor told the Journal of Commerce.

Sunil Vaswani, executive director of the Container Shipping Lines Association (India), said rates have increased about 70% to the US and almost tripled to Europe in the last month. “It’s still an evolving situation,” Vaswani said.

However, some industry observers believe that carriers will struggle to hold this rate cycle for long.

“We foresee that the rate hikes will flatten out in the mid- to long-term,” Christian Roeloffs, CEO and co-founder of equipment marketplace Container xChange, said in a report. “We have enough capacity that can be soaked up in longer transit times and yet not cause permanent capacity crunch.”

By: Bency Mathew / JOC

View All News Articles