Feds Told to Start Rating ‘Unrated’ Trucking Companies for Safety

WASHINGTON — Major trucking companies and brokers who book their freight are pressuring the Federal Motor Carrier Safety Administration to attach a safety rating to carriers operating without such a rating — a situation that exists for over 90% of the freight market.

The concern comes as FMCSA looks at developing a new way to verify when a motor carrier is fit to operate trucks in interstate commerce, known as a safety fitness determination (SFD). The agency issued a preliminary advance notice of proposed rulemaking (ANPRM) in August to get public feedback on whether and how to revamp its current rating methodology.

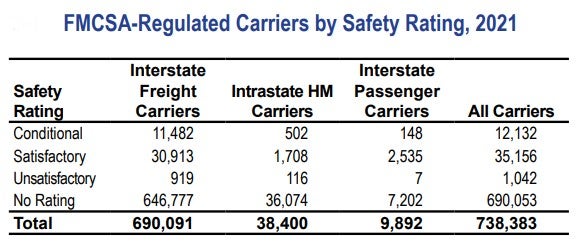

FMCSA’s own statistics red-flags the problem. Of 690,091 interstate freight carriers eligible for an FMCSA safety rating in 2021, 646,777 — roughly 94% — did not have a rating, according to the agency’s most recent annual safety data, published in December 2022.

“A system that rates less than 10% of the eligible population is unacceptable,” wrote Lane Kidd, managing director of the Alliance for Driver Safety & Security, known as the Trucking Alliance, in comments responding to the proposed rulemaking. The group consists of nine of the country’s largest truckload carriers, including J.B. Hunt (NASDAQ: JBHT), Knight-Swift (NYSE: KNX) and Schneider National (NYSE: SNDR).

“These unrated carriers are treated disparately by brokers and shippers who must rely on other metrics to make important safety-based business decisions,” Kidd stated.

The Transportation Intermediaries Association, which represents truck brokers and 3PLs, agrees.

“TIA supports a speedy rulemaking because one of the most significant challenges for the third-party logistics industry is the manner in which motor carrier safety ratings are currently being used by personal injury lawyers, insurers, and the media, among others,” said TIA Vice President of Government Affairs Chris Burroughs in comments filed with the notice.

“The misuse of safety ratings, which manifests itself in nuclear verdicts, higher insurance rates, and reputational damage is especially acute in light of the fact that 90% of motor carriers are currently considered ‘unrated’.”

FMCSA admits to regulatory loopholes

FMCSA’s current SFD system is based on data collected during a compliance review investigation, conducted either on-site at the motor carrier’s place of business or remotely through a review of its records using a secure portal.

After analyzing six factors — which incorporate crash involvement and hours of service violations — a carrier is assigned one of three safety ratings: satisfactory, conditional or unsatisfactory.

But because of loopholes in the system, a carrier is not prohibited from operating with a conditional rating even though a review revealed a safety breakdown. For example, a carrier with a documented noncompliance in vehicle maintenance and controlled substances testing would receive a proposed conditional rating. If the proposed rating becomes final, it still allows the carrier to continue operating.

FMCSA also admits that the current SFD process strains agency staff, reaching only a small percentage of carriers. That leaves the majority without a rating at all, setting up the potential for a huge number of unsafe trucks operating on the highways at any time.

“Because the agency has resources to issue safety ratings to only a small percentage of motor carriers each year, a safety rating does not necessarily reflect the current safety posture of a motor carrier,” the agency acknowledged in the ANPRM.

Potential solutions lack consensus

Most groups representing carriers, shippers, brokers and safety advocates agreed that the current system was broken and needed to be made simpler and more clear, but differed on how to make that happen.

Solutions ranged from using a single “unfit” category, advocated by the Commercial Vehicle Safety Alliance as well as proposed previously by FMCSA, to expanding to a five-point number system, supported by Tesla (NASDAQ: TSLA).

“The current system is confusing and not intuitive,” commented Madan Gopal, staff safety strategy engineer for the Austin, Texas-based company, which is ramping up production of its long-delayed Semi electric truck.

“Also, the meanings of ‘unsatisfactory’ and ‘conditional’ may be confused with one another. A five-point system, with 1 assigned to ‘conditional’ and 5 assigned to ‘unfit-out of service’ may be more understandable.”

In between CVSA and Tesla is a call, by TIA, to move to a simple fit/unfit rating system.

“For many years, TIA has been a strong proponent of a “red light/green light” system for the use of motor carriers as a substitute for the current, confusing and conflicting” system, Burroughs asserted.

“Not providing a safety rating of some kind for every carrier would continue the confusion and ambiguity that exists in the current [process]. This important change is not only essential to eliminating unsafe motor carriers from the road but also eliminating confusion in the marketplace as to what the existing ratings mean.”

The National Industrial Transportation League, a shipper group supporting TIA, commented, “Think how many bad actors would be put out of business if shippers and 3PLs were told not to use them (unfit). A simple binary safety rating system that distinguishes a fit or unfit carrier will help clear up a great deal of confusion.”

But several carrier groups — the National Motor Freight Traffic Association, representing LTL carriers; the National Association of Small Trucking Companies, which represents small-business carriers; and the National Private Truck Council (NPTC) — believe FMCSA should retain its three-tier system.

Among reasons cited for keeping three categories versus a binary system, NPTC asserted that eliminating “conditional” as a rating would mean carriers currently holding that status “would be compelled to suspend operations until such time as the agency could conduct another compliance review and reconsider the safety fitness rating, whenever that might be,” the group stated.

“It essentially forces the company out of its trucking operations.”

By: John Gallagher / FreightWaves

View All News Articles