-

08

Jul

Trucking fleet failures accelerated rapidly in June

Data from the Federal Motor Carrier Safety Administration (FMCSA) analyzed by FTR Transportation Intelligence shows that fleet failures started to accelerate in May and rapidly picked up pace in June, setting a record.

FTR’s VP of Trucking Avery Vise, who is monitoring the FMCSA data, told FleetOwner that the failures correlate with this spring’s spike in diesel prices and that the “revocations” of operating authority are likely to stay high as the per-gallon cost of trucking’s main fuel remains at historically high levels.

“June probably is the first month that we are seeing large numbers of carriers that might have failed after the two-week, $1.15 surge in diesel prices in March,” he explained. “I would expect net revocations to remain high—and perhaps rise—for several more months at least.”

The price of diesel actually started to rise in the winter and spring of 2021 as the country began to come out of the COVID-19 pandemic and demand subsequently increased (the U.S. average reached $3.70 per gallon by November), but prices took off this March shortly after the Russian invasion of Ukraine and the resulting market shock (the national average rose 75.5 cents the week of March 7) and have since stayed at record levels due to a combination of factors—inflation, oil prices, demand, distillate inventories, and reduced refining capacity among them.

The government agency that tracks oil and distillate data, the U.S. Energy Information Administration (EIA), has not been able to release diesel numbers since June 13 because of damage to its servers, but motor club AAA monitors the data and sees the national average for trucking’s main fuel still sitting at a record on July 5: $5.726 per gallon. The average price of diesel at this time last year was $3.252 per gallon, or $2.474 lower, according to AAA. EIA announced that it will return with diesel price data late in the day on July 7, and FleetOwner will resume reporting on those numbers.

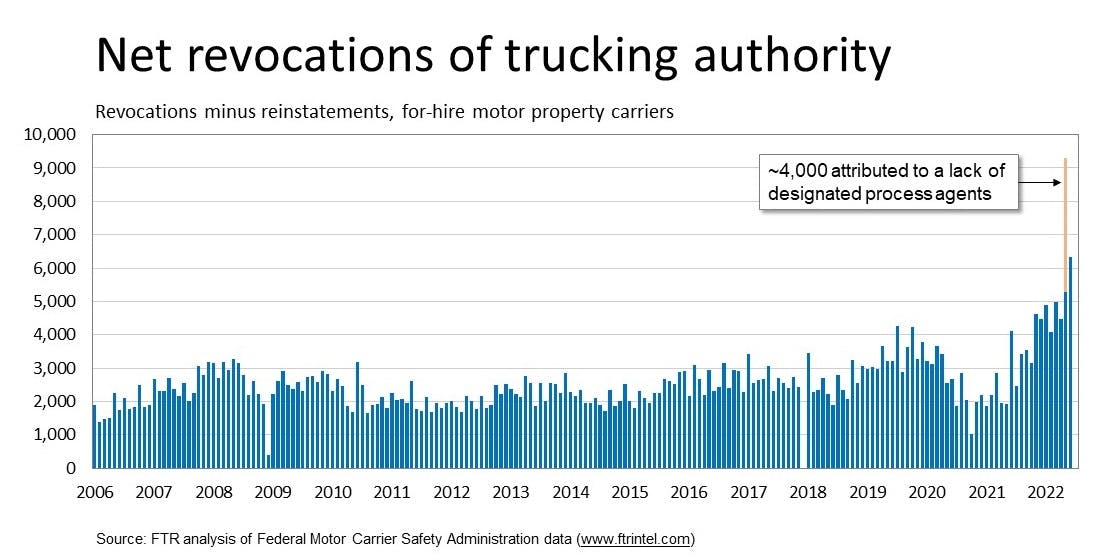

Net FMCSA “revocations” of trucking authority totaled more than 6,300 in June, which is the most ever recorded except for the nearly 9,300 in May, according to Vise. But, he said, the May spike is an outlier that included about 4,000 revocations resulting from a special FMCSA enforcement of rules that require carriers—as well as brokers and freight forwarders—to arrange for process agents in every state in which they operate.

Norita Taylor, director of public relations for the Owner-Operator Independent Drivers Association, which represents small carriers and independent truck drivers, the demographic in the industry arguably most vulnerable to historic diesel prices, said at least some of the May and June FMCSA revocation increases might be the result of the agency culling inactive U.S. Department of Transportation operator numbers. Taylor was skeptical of the fleet failure trend that FTR is measuring.

“I’m not sure it’s possible to know from [FMCSA’s] data how many companies are leaving the industry,” Taylor said in an email to FleetOwner. “For example, some switch from being under their own authority, to leasing on to someone else.”

“We do take carriers going out of business very seriously,” the OOIDA rep added. “Hence our educational efforts through videos, seminar, media, our website, etc. We are continually trying to educate our members regardless of how the freight market is going.”

“One development that could stem that tide might be a substantial and sustained decline in diesel prices. However, that’s complicated,” Vise added. Volatility in spot rates and the state of the economy also play a part in the total picture of fleet failures, he said.

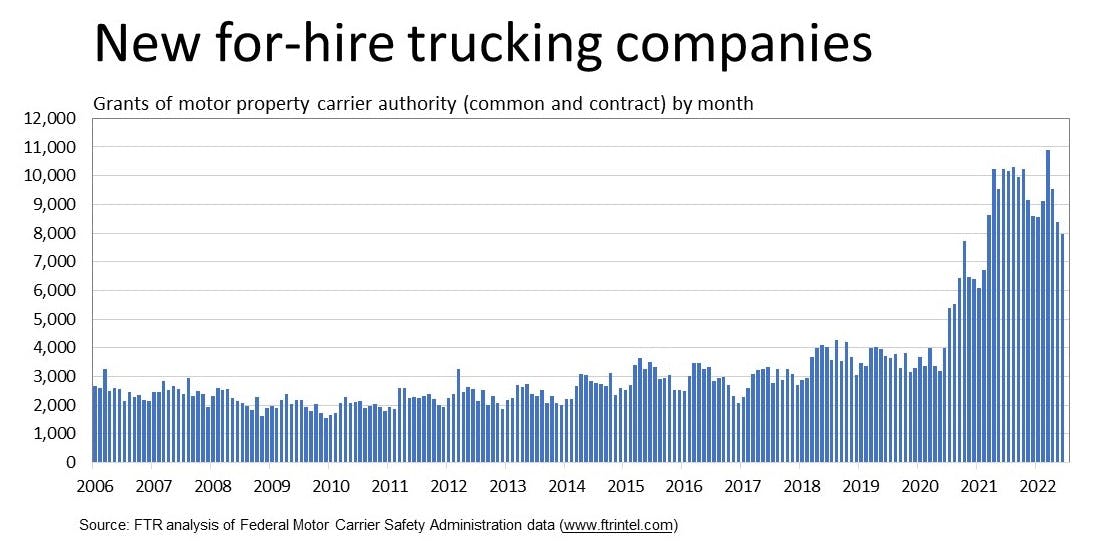

Vise did report that while the number of carriers is falling, their ranks remain high compared to the pre-pandemic norm. The nearly 8,000 carriers authorized in June is the lowest since February 2021, but the average from 2015 through June 2020 was much lower, around 3,000 per month, he said.

“While I believe we will continue to see the number of new carriers decline, I would not be surprised to see it remain higher than typical before the pandemic,” he added. “One issue is the shift from a leased owner-operator model to a brokerage model for surge capacity, and that shift will accelerate now that California can enforce AB5 on carriers. Indeed, I would not be surprised to see a spike in new carriers over the next several months for that reason. Another factor is that digital freight platforms are making it easier for brokers to manage capacity made up by single-truck operations.” by Scott Achelpohl at FleetOwner