Diesel Reaches Highest Cost Since 2014

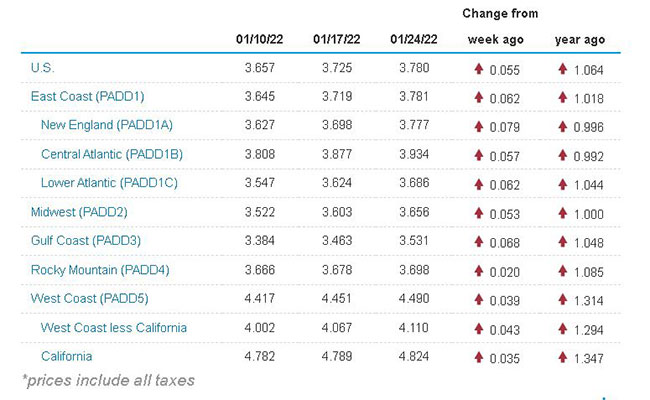

The national average price of a gallon of diesel reached its highest cost in more than seven years, rising 5.5 cents to $3.78, according to Energy Information Administration data released Jan. 24.

A gallon of diesel costs the most since it was $3.801 on Sept. 15, 2014. Diesel’s price has surged 16.7 cents over the past three weeks. A gallon of diesel now costs $1.064 more than it did at this time in 2021.

All 10 regions in EIA’s weekly survey recorded gains, with the largest being 7.9 cents in New England and the smallest being 2 cents in the Rocky Mountain region.

Gasoline followed diesel’s path, increasing 1.7 cents to $3.323. It rose in each region except the Rocky Mountains and West Coast. A gallon on average costs 93.1 cents more than a year ago.

U.S. On-Highway Diesel Fuel Prices

One carrier executive said rising diesel prices, among other factors, could push shippers to use other transportation modes.

“As an organization, we see tremendous pent-up demand to convert highway freight to intermodal with elevated truck rates, the tight labor market, higher fuel prices, and a 60% improvement in carbon efficiency intermodal offers versus truck,” said Shelley Simpson, chief commercial officer at J.B. Hunt Transport Services Inc., during a recent earnings call.

Meanwhile, fuel surcharges are designed to help truckers offset fast-rising fuel prices.

EIA noted shippers and transportation companies negotiate fuel surcharges privately, and it does not endorse a particular method.

Fuel surcharges were an issue between carriers and shippers about 20 years ago, Avery Vise, vice president of trucking at FTR, told Transport Topics. “At this point, they are entrenched. They are not going away.”

Vise said another thing about fuel surcharges is they also give carriers more incentive to be efficient.

“Surcharges can actually generate margin if your operation is more efficient than what the surcharge assumes [in terms of the fuel efficiency of trucks],” Vise said.

Fourth-quarter fuel surcharge revenue at J.B. Hunt was $390.4 million compared with $185.8 million a year earlier, the company reported. In its truckload segment, loaded miles increased to 61.8 million compared with 45.4 million a year earlier. The segment’s average number of tractors in the quarter rose to 2,168 compared with 1,772 a year earlier.

Heartland Express reported fuel expenses in the fourth quarter climbed to $23.5 million compared with $20.6 million a year earlier. Fuel surcharge revenue was $20.5 million.

While fuel surcharges can protect carriers against increases over the life of a contract, “at the same time, they’re also a factor that can greatly impact overall shipping costs,” Averitt Express wrote in an online post.

EIA forecast that in 2022 and 2023 crude oil prices will remain high enough to encourage growth in the number of active drilling rigs and continued improvement in drilling efficiency.

U.S. drillers added three oil rigs to raise the number of rotary machines drilling for crude to 604, according to weekly data for Jan. 21 from energy technology company Baker Hughes. The number of rigs was 226 higher compared with a year earlier.

Host Seth Clevenger, fresh from CES, discusses autonomous and electric trucks with Joe Adams of Kenworth and Cheng Lu of TuSimple. Hear a snippet above, and get the full program by going to RoadSigns.TTNews.com.

Baker Hughes ranks No. 27 on the Transport Topics list of the top private petroleum/oil field carriers in North America.

West Texas Intermediate crude closed at $86.84 on Jan. 26, and has traded in a 52-week range of between $48.45 to $87.95.

North American oil drillers appear likely to expand spending by more than 25% this year while overseas explorers are on course for a more modest increase in the mid-teens, Halliburton Co. executives said on a recent earnings call after the company reported its biggest quarterly profit in seven years.

“When you’re talking petroleum, everything is just global,” Vise noted. “So many things in trucking are not necessarily global, but when we start talking about petroleum, what Russia does, what OPEC does just has so much impact on the near term.”

U.S. shale oil companies are using almost all of the fracking equipment and crews available as exploration expands, accelerating cost inflation and pointing to worsening supply chain disruptions across the industry, Bloomberg News reported.

Vise agreed the oil market now is having a good effect on flatbed demand, especially regionally with the oil field activity. “We have seen flatbed spot rate metrics get much stronger in the last few weeks. And that does correlate with rig counts going up.”

EIA reported U.S. crude production dropped an estimated 1% in 2021, but is expected to increase 6% in 2022 and 5% in 2023.

By: Roger Gilroy / TTNews

View All News Articles